Domain Name Sale Capital Gains

Ie would you call the sale of a website the sale of working capital and as such is subject to the capital gains discounts. Where a business or individual trades in domain names for profit the domain names would form trading stock and sale proceeds would be treated as trading income for tax purposes.

How To Reduce Or Avoid Capital Gains Tax On Property Or Investments Capital Gains Tax Capital Gain Investing

How To Reduce Or Avoid Capital Gains Tax On Property Or Investments Capital Gains Tax Capital Gain Investing

Since then a big US crowd has come along and expressed an interest in buying the domain name.

Domain name sale capital gains. 2 You may report zero cost-basis for the eminent domain property which will make the entire proceeds from the sale subject to capital gains tax generally 15 or 25 depending on your tax bracket. Im seeing my accountant. Get all the latest India news ipo bse business news commodity sensex nifty politics news with ease and comfort any time anywhere only on Moneycontrol.

Search for and buy a cheap new CAPITAL domain extension now. The taxable amount is 6500-2500 4000. Im self-employed and write software but Ive never sold a domain before - so its not my regular line of work.

Seller of website owes 600 at tax time. When you sell an asset for more than it cost you to acquire it the difference is known as a capital gain. Or am I totally off the ball.

The market for domain name purchases and sales offers indisputable evidence that domain names appreciate in value. The basis cost to create the website including the domain is 2500. 5 years ago I registered a domain with a couk.

For example if you paid 1000 to buy stock and sell the same stock for 1200 net of. Lets say I manage to sell the domain for 60k. If you purchase property to use in your business your.

Are there any documents I should provide to the IRS when I do my taxes. Consequently the taxpayers capitalized costs of acquiring a domain name that is registered as a trademark whether acquired as a separate asset or as part of the acquisition of a trade or business are an amortizable Code Section 197 intangible. If you hold that asset longer than one year it will likely be considered a long term capital gain.

Because they satisfy the two-factor test the increase in their value should be deemed capital in nature and the tax treatment applicable to capital gains and losses should apply to domain name sales. Can domain name sales be qualified as capital gains. I will have a 150000 capital gain on the sale of a domain name.

I consider it part of my collectible business DBA that includes other collectibles such as silver coins vehicles etc. I was just wondering what everyone else categorises undeveloped domain sales for their taxes. I owned a domain name for more than one year so Im thinking I can get the long-term tax rate on the sale income.

Under either option the purchase date is the date you originally purchased the property. Seller is in the 25 income bracket so they pay a 15 capital gains tax on the profit. When you sell a site the sale includes a domain the websites code brand reputation and goodwill databases customer lists and image assets.

When you sell your domain the gain will be determined by how you treat these assets. 263 as intangible assets and that those costs should be amortized under Sec. And do you categorise developed sites differently.

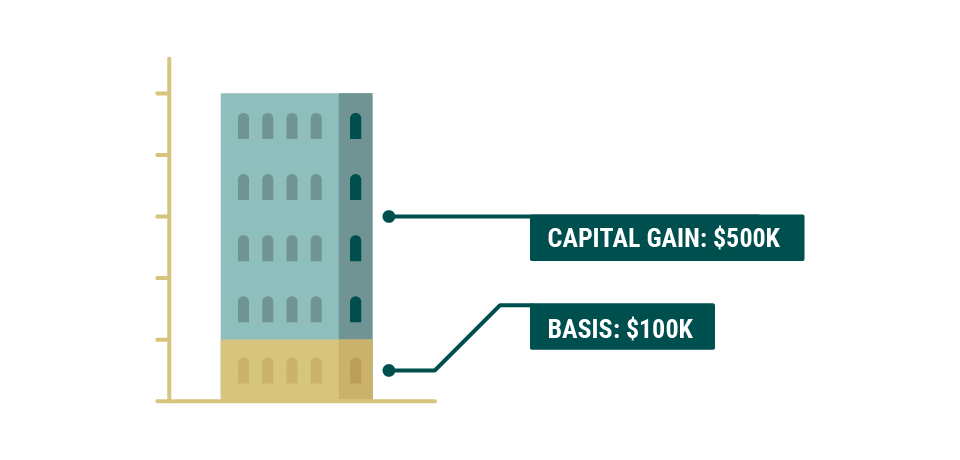

Digital automated services means any service transferred electronically such as over the Internet using one or more software applications. When a capital asset is sold the difference between the basis in the asset and the amount it is sold for is a capital gain or a capital loss. 197 over a 15-year period.

Because sale of a domain name would be considered a sale of digital automated services it would be subject to sales or use tax. I am worried about potential capital gains tax liability for the domain sale but cant figure out whether I should be worried about this or not. If you treated them as capital assets your gain will be a capital gain.

Website sells on Flippa for a total of 6500 after listing fees. But websites often include copyrights which are specially excluded from capital gain treatment. In the CCA a company acquired internet domain names on two separate occasions.

Accordingly these capitalized costs may be amortized. I dont buy and sell domains for profit so Ive never claimed a tax deduction for the domain name renewal fees or anything since I bought the domain many years ago. Normally when a business or an individual sells a domain name any gain on disposal would be taxed under the capital gains rules as a gain on the disposal of an asset.

Essentially the IRS determined that the costs of acquiring domain names are to be capitalized under Sec. Can I do a 1031 asset exchange to shelter some of mu taxes by purchasing more silver coins from the sale of the domain name to shelter some of the capital gains. If you treat your domains as 197 intangibles and thus had ordinary deductions through amortization your gain will be ordinary.

Go Daddy Is Destroying Domain Sales The Perpetual 80 Day Auction And Sedo S Refusal To Remove Domains From Go Daddy Onlinedomain Com

Go Daddy Is Destroying Domain Sales The Perpetual 80 Day Auction And Sedo S Refusal To Remove Domains From Go Daddy Onlinedomain Com

A Guide To Domains And Web Hosting Infographic Web Hosting Infographic Website Hosting Web Hosting

A Guide To Domains And Web Hosting Infographic Web Hosting Infographic Website Hosting Web Hosting

Heretake Com How To Memorize Things Online Real Estate Online Marketing

Heretake Com How To Memorize Things Online Real Estate Online Marketing

Progressive Vs Regressive Tax Tax Deductions Income Tax Tax Services

Progressive Vs Regressive Tax Tax Deductions Income Tax Tax Services

How To Use Gmail With Your Own Custom Domain Business Blog Online Business Marketing

How To Use Gmail With Your Own Custom Domain Business Blog Online Business Marketing

Is Reinvestment Of Ltcg In The Name Of Spouse Eligible For Capital Gains Exemption

Is Reinvestment Of Ltcg In The Name Of Spouse Eligible For Capital Gains Exemption

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

9 Ways To Avoid Capital Gains Tax On Commercial Investment Property In 2021 Propertycashin

9 Ways To Avoid Capital Gains Tax On Commercial Investment Property In 2021 Propertycashin

Picking The Right Two Word Domain Name Can Mean The Difference Between A Valuable Brand Or An Utterly Worthless Domain Name Here Is M Words I Decided Reading

Picking The Right Two Word Domain Name Can Mean The Difference Between A Valuable Brand Or An Utterly Worthless Domain Name Here Is M Words I Decided Reading

How Much Is A Domain Name Worth

How Much Is A Domain Name Worth

Wreckle Fitnessmale Yoga Training Brand Names Stress

Wreckle Fitnessmale Yoga Training Brand Names Stress

Capital Gains Tax On Inherited Property Bhhs Fox Roach

Capital Gains Tax On Inherited Property Bhhs Fox Roach

Hempchatt Com Domain Cannabinoids Understanding

Hempchatt Com Domain Cannabinoids Understanding

How To Calculate Capital Gains And What Is Indexation

How To Calculate Capital Gains And What Is Indexation

Https Resources Taxschool Illinois Edu Taxbookarchive 2013 C1 20form 204797 Pdf

10 Long Term Capital Gain Tax To Benefit P2p Lending Players Read Our Complete Article Published On Moneycon Peer To Peer Lending Money Lender Personal Loans

10 Long Term Capital Gain Tax To Benefit P2p Lending Players Read Our Complete Article Published On Moneycon Peer To Peer Lending Money Lender Personal Loans

Tips For How To Sell Your Domain Name On Afternic Godaddy Blog

Tips For How To Sell Your Domain Name On Afternic Godaddy Blog

Buy Brand Company Domain Names Squadhelp Company Names Company Logo Tech Company Logos

Buy Brand Company Domain Names Squadhelp Company Names Company Logo Tech Company Logos

Post a Comment for "Domain Name Sale Capital Gains"