Domain Name Registration Tax Deduction

Capital costs and ongoing recurring business expenses. Domain investors may be able to deduct these expenses associated with their business.

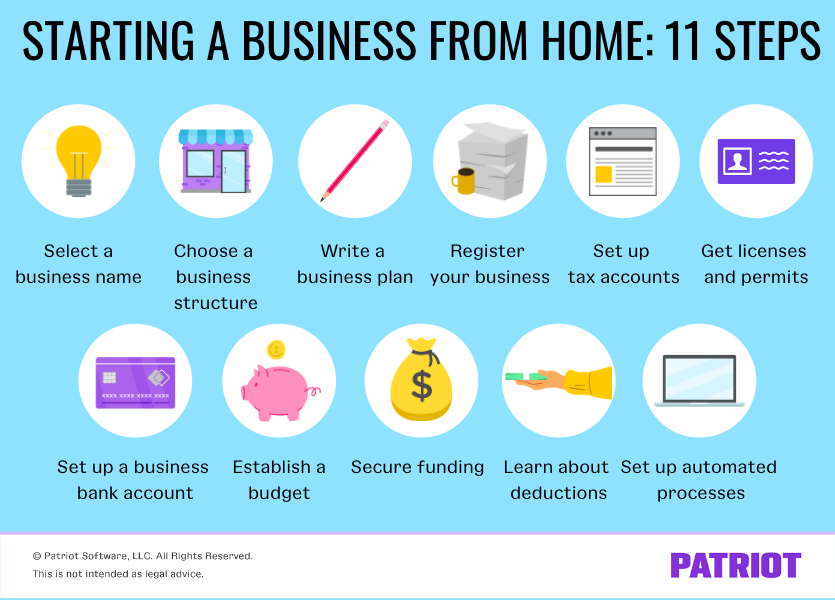

Starting A Business From Home 11 Steps To Follow

Starting A Business From Home 11 Steps To Follow

162 or must be capitalized as an intangible asset under Sec.

Domain name registration tax deduction. The IRS looks at domain name costs in two ways. In other words the cost must be in the form of a personal property tax not an excise tax. Deduct up to 5000 of the costs in the year that your business started and Amortize meaning deduct over a period of time any of the costs beyond the 5000 over 15 years starting with the month that the business starts.

Tax returns are due April 15 this year which means its crunch time. If a domain name is purchased and developed into a brand identity the IRS generally regards the money spent as capital costs that. An example is Washington State.

To receive the deduction you must. 29 will apply to the cost of the domain name allowing the tax treatment to follow the accounting treatment with a deduction for depreciation if appropriate. The first issue is whether the cost the taxpayer incurred to acquire a generic or nongeneric domain name from a secondary market and then used in the taxpayers trade or business is currently deductible under Sec.

If part of your registration is indeed deductible you must itemize your deductions to claim it rather than using the standard deduction. A domain name can be considered an asset in several situations. The portion of the registration fee that is charged based on the vehicles value - as opposed to its size age or other characteristics - can generally be claimed as a deduction.

Accordingly these capitalized costs may be amortized. Internet domain name registration services are generally subject to retail sales or use tax in that specific state. The Schedule C isnt really that complicated especially if you use a tax prep program like TurboTax or TaxCut.

However since a domain name is usually intended to be used over an unknown period of time the IRS believes no deduction under IRC 167 would be available. You would have to look up each state or the specific state that you are interested in. In order to receive the car registration deduction your state must base its registration fee or at least partly base it on vehicle value as opposed to weight.

If you dont decide to do go the startup route the expenses are only deductible when you shut down or sell your business. Thus registrar neither owns any domain name nor grants any right to use such domain name to the registrant upon registration of domain name. To make matters more complicated the seller of the domain would have to pay taxes on his gain before making the donation.

The amount agreed on was 7500 and I received a letter from the nonprofits CEO detailing the terms. These are deductible from income a business may earn in the same tax year. If youre like me and are still waiting for K-1s from investments you can extend your tax filing deadline to October 15 2019.

Consequently the taxpayers capitalized costs of acquiring a domain name that is registered as a trademark whether acquired as a separate asset or as part of the acquisition of a trade or business are an amortizable Code Section 197 intangible. General registration added domain name protection services and recurring maintenance costs for a domain name are all considered regular business expenses. If the business that acquired the domain name is a company the corporate intangible assets regime FA 2002 Sch.

For most freelance businesses deducting website expenses small business web services or deducting domain name registration fees happens on the Schedule C. Each state has their own laws. In order to take the deduction the domain owner would have to sell the domain and then donate the proceeds.

Domain names are generally regarded as intangible personal property. Further web hosting is an independent process of allocating space on a server to store all website files and make the website accessible through the World Wide Web. As a result the taxpayer may only deduct amortization for the intangible if the taxpayer can show that the domain name has a limited useful life.

The nominal annual domain name registration fees are generally deductible. An immediate tax deduction can also be claimed for government fees such as those charged by ASIC that are included in the formation of a business structure such as a company or discretionary trust. Last year I donated a domain name to a nonprofit in Florida for use as their main website not to sell.

How do I enter this info into my taxes and would the IRS accept this as a tax deductible don. Httpwwwirsgovirmpart4irm_04-043-001-cont04html Intangibles You must generally amortize over 15 years the capitalized costs of section 197 intangibles you acquired after August 10 1993. In addition the state must charge the tax annually even if you pay it more or less often and you must have paid the tax during the current tax year.

What Expenses Can You Deduct From Taxes With An Online Business

What Expenses Can You Deduct From Taxes With An Online Business

How To Get Your Free Domain Name For Life No Registration Or Renewal Fees Domain Name Ideas Free Website Domain Free Domain

How To Get Your Free Domain Name For Life No Registration Or Renewal Fees Domain Name Ideas Free Website Domain Free Domain

How To Choose The Perfect Name For Your Business Check Out This Step By Step Guide To Help You Choose T Business Names Names For Companies Home Based Business

How To Choose The Perfect Name For Your Business Check Out This Step By Step Guide To Help You Choose T Business Names Names For Companies Home Based Business

Trademark Do It Yourself Legal Book Nolo

Trademark Do It Yourself Legal Book Nolo

Bluehost Pricing Plans Price List Things You Need To Know

Bluehost Pricing Plans Price List Things You Need To Know

Categorizing Your Photography Business Tax Deductions Cheat Sheet Lin Pernille

Categorizing Your Photography Business Tax Deductions Cheat Sheet Lin Pernille

Tax Expenses Spreadsheet Eymir Mouldings Co Small Business Income 959f8efc70670771a189bda9e78 Golagoon

Domain Name At Rs99 Only Website Domains Blog Names Blogging Basics

Domain Name At Rs99 Only Website Domains Blog Names Blogging Basics

Bluehost Pricing Which Plan Is Best For Your Site 2021

Bluehost Pricing Which Plan Is Best For Your Site 2021

Home Office Tax Deduction Prerequisites And Tips Ionos

Home Office Tax Deduction Prerequisites And Tips Ionos

Where Do I Deduct Website Expenses On Schedule C Taxes Arcticllama Com

Where Do I Deduct Website Expenses On Schedule C Taxes Arcticllama Com

How To Transfer A Domain Name To A New Registrar Bluehost Support

How To Transfer A Domain Name To A New Registrar Bluehost Support

5 Simple Steps For Understanding Your Deductions Andi Smiles

5 Simple Steps For Understanding Your Deductions Andi Smiles

Learn How To Set Up Your Own Web Business And Start Selling Online In This Arti Domain Registration Domain Re Web Business Online Business Business Basics

Learn How To Set Up Your Own Web Business And Start Selling Online In This Arti Domain Registration Domain Re Web Business Online Business Business Basics

The Top 10 Trending Keywords In Domain Registration Have Been Released For May These Can Provide Inspiration Or Give Socia Keywords Words Domain Registration

The Top 10 Trending Keywords In Domain Registration Have Been Released For May These Can Provide Inspiration Or Give Socia Keywords Words Domain Registration

The Epic Cheatsheet To Deductions For The Self Employed Business Tax Deductions Small Business Tax Business Tax

The Epic Cheatsheet To Deductions For The Self Employed Business Tax Deductions Small Business Tax Business Tax

Post a Comment for "Domain Name Registration Tax Deduction"